Instant Home Insurance Quote

All We Need Is Your Address, NO BS!

What is Medical Payments Coverage?

Homeowners insurance medical payments coverage, also called MedPay or Coverage F, is a type of coverage on your homeowners insurance policy. This pays for medical expenses if a guest in your home or on your property sustains a bodily injury. It doesn’t matter who is at-fault; MedPay will assist in reimbursing you for the medical expenses.

The standard limit is $1,000-$5,000 for this coverage. This means that if someone gets severely injured at your house and it costs more than $5,000, it is up to you to pay the rest out-of-pocket. It is only intended for small medical claims and usually prevents injuries from escalating into lawsuits. An injured houseguest may think twice about suing you if you offer to help cover their medical bills.

What Does Medical Payments Cover?

Medical payments coverage is a type of liability coverage. It covers houseguests’ injuries on your property, no matter who is at-fault.

According to the Texas Department of Insurance, medical payments in your homeowners insurance can also cover accidents away from home. An example of this is if your dog bites someone at the park. Some instances that your policy could cover are: if an accident is caused by you, by a pet you own, and if an employee of your household causes it.

Homeowners insurance medical payments to others’ coverage will pay for “necessary” medical expenses within three years from the date of an accident. Here’s a list of what could be covered and potentially reimbursed by your provider:

- Dental

- Emergency transportation (ambulance rides)

- First Aid

- Funeral services

- Hospital stays

- Medical expenses

- Prosthetic devices

- Professional Nursing

- Surgery

- X-ray

Checking with your insurance provider is the only way to know what coverage you get in your homeowners insurance!

What Isn’t Covered by Medical Payments Coverage?

It is important to note that medical payments do not extend to the household’s permanent members or employees (groundskeeper, housekeeper). This coverage is specifically for guests of the property.

Medical payments also does not cover property damage for guests; your liability insurance would cover that through your homeowners insurance policy. Also excluded would be legal fees you could acquire if the guest sues due to an injury.

Homeowners insurance medical payments coverage does not cover these instances:

- Communicable diseases

- If the property where the injury occurred is not insured

- Medical expenses due to controlled substance abuse

- The injury came about through a lack of maintenance of the home

- The injury was intentional or expected

How Much Medical Payments Coverage Do I Need?

Insurance coverage needs are unique to everyone. Suppose you are worried about being stuck in a legal battle because of a guest getting injured at your home. In that case, medical payments coverage is an excellent option for you. We recommend that if you add this coverage to your policy, you have the highest coverage limit offered by your provider. A standard carrier provides $1,000 to $5,000 coverage options, but some carriers offer up to $25,000 in coverage.

TGSI Tip: If you are concerned about the cost of your policy, remember that the liability section (personal liability coverage and medical payments coverage) usually provides the most bang for your buck! So, opting for the maximum coverage won’t cost you much more than choosing the minimum.

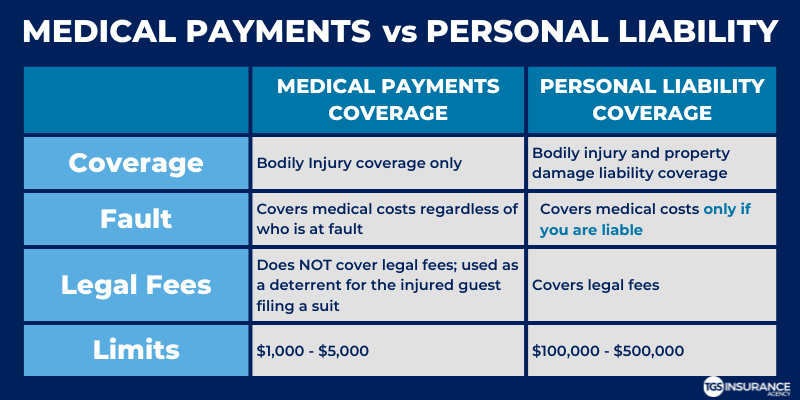

What is the Difference Between Liability Coverage and Medical Payments Coverage?

A typical homeowners insurance policy has six basic protections, two of which are liability insurance and medical payments coverage. These both cover the medical expenses of a guest who sustains an injury while on your property; they differ by covering different circumstances:

Coverage

Medical payments only cover bodily injury; no property damage is eligible for protection in this type of coverage. Personal liability coverage does cover both bodily injury and property damage.

For example, if your tree branch falls on your guest’s vehicle while in your driveway and causes them to get hurt and their car is damaged, medical payments would only cover the injuries, not the car damage.

Fault

Medical payments will pay medical bills- up to your coverage limits- regardless of who is at fault. On the other hand, liability coverage will only cover costs if you are the one liable for causing the injury.

Legal Fees

Medical payments are used to avoid getting pressed with legal fees if someone is injured at your house. If you offer to cover a guest’s minor injury, they are less likely to sue.

Limits

The coverage limits for these two portions of your homeowners insurance differ drastically. Assessing individual situations is the best way to determine which coverage should be used.

Medical payments may be the best coverage option if your child has a friend over and sprain their ankle and need to visit the hospital. The injury is minor and won’t be as expensive as major surgery.

On the other hand, if someone is over and falls down your stairs, leaving them with a broken ankle, it might be a better situation to use personal liability coverage. Broken bones require many doctor visits, possible surgeries, and months of rehabilitation. You don’t want to be stuck with a $5,000 limit on a severe injury.

TGS Wants To Help You Find The Right Homeowners Insurance!

At TGS Insurance Agency, we believe homeowners insurance should be simple, and it should be affordable. We shop every client’s policy through our partner carriers to offer our client’s the best policy available on the market at an unbeatable rate. The best part? We do it fast! Your time is essential- don’t waste it on insurance. Get started today by getting your Instant Home Insurance Quote today!

Explore Other Homeowners Insurance Coverages:

Recent Homeowners Insurance Articles:

- Thanksgiving Fire Safety: Protect Your Home, Your Family, and Your Peace of Mind

- Fall Home Maintenance Checklist: Prevent Costly Insurance Claims Before Winter

- Who Needs to be Listed on Homeowners Insurance

- Does Homeowners Insurance Cover Mold?

- Actual Cash Value vs. Replacement Value: What’s the Difference, and Where Does Market Value Fit In?