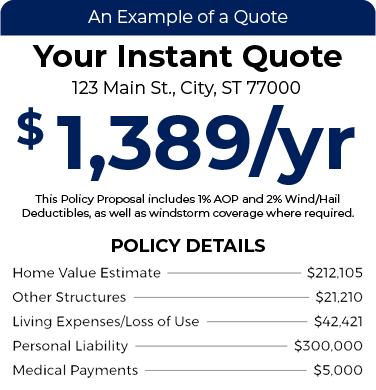

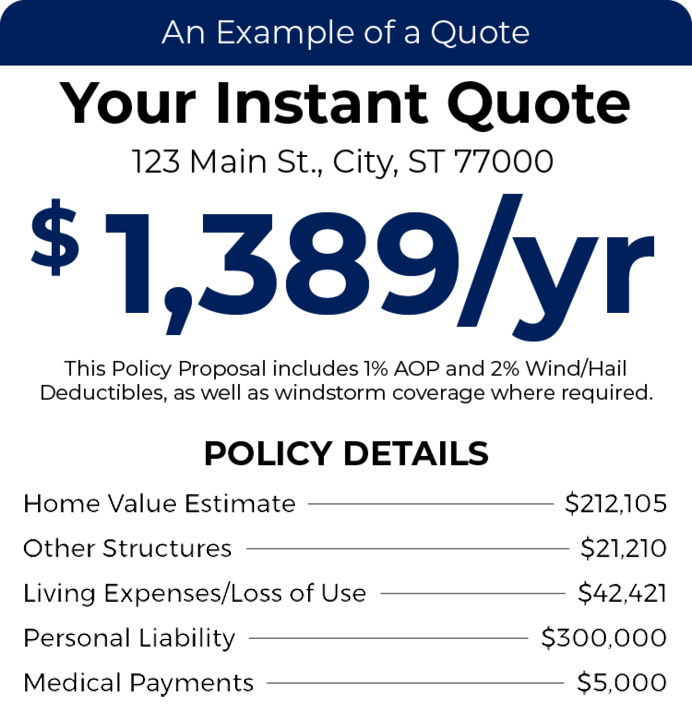

Instant Landlord Insurance Quote

Understanding The DP2 Insurance Policy

Table of Contents

What is A DP-2 Policy?

A DP-2 insurance policy is one of three types of coverage used for landlord insurance and rental properties, and it falls into the middle coverage-wise between DP-1 and DP-3 policies. Sometimes, DP-2 is referred to as Dwelling Fire Form 2 and provides adequate protection for landlords.

What Do DP-2 Policies Cover?

A DP-2 insurance policy offers dwelling coverage on a replacement cost basis and does not account for depreciation. This policy covers your property’s primary structure, and connected structures like;

- fences,

- sheds,

- or detached garages

Loss of rent is covered in most DP-2 policies. If your rental property is damaged during a covered peril, then your insurance provider will give you compensation for the lack of rent. This could save rental property owners a lot of money and prevent stress during a potentially expensive situation.

This policy also protects rental properties from any of the named peril losses. It’s a broad-form insurance policy that covers more perils than the basic DP-1 policy but less than the more robust DP-3 insurance policy. Perils that are covered can vary, but here are some of the most commonly listed.

- Fire or lightning

- Windstorms and hail

- Smoke or ash

- Explosions

- Damage caused by vehicles

- Damage caused by aircraft

- Falling objects

- Freezing of household systems

- Sudden/accidental tearing, cracking, burning, or bulging of home systems

- Weight of ice, snow, and sleet

- Water overflow or discharge (plumbing, air conditioning, and other appliances)

- Power Surges

- Riots

- Volcanic Eruptions

DP-2 insurance only covers perils or events listed in the policy. However, you can also add personal liability coverage to a DP-2 policy to help offset payments if, for example, a guest claims you’re liable for damages or injuries while on your property.

When Do I Need A DP-2 Policy?

A DP-2 policy is ideal for homeowners who rent all, or even part, of their home for income purposes. If you own one or multiple rental properties, you can benefit from having a DP-2 policy. Another thing to consider is if you bought a new home and are now renting your current one until you sell it, you will probably need some dwelling property policy.

How To Buy A DP-2 Policy

Whether this is your first rental property or you are just adding another to your real estate empire, no one enjoys the headache of shopping for insurance. That’s where TGS comes in to save the day! Tell one of our licensed agents what you are looking for, and they will shop your policy to find you the best rates! Keep your rental property safe and insured with the help of TGS Insurance and the 35+ A-rated carriers we use. Get your hassle-free quote today!