According to ElectricRate, over 100,000 Texans are utilizing solar power. With over 3,700 sunny hours a year, harvesting solar for your home is simple, cost-effective, and can add value to your home. If you are pondering adding solar panels to your home, you must also consider how it will affect your home insurance. Asking an agent is the best way to know if your home insurance covers solar panels’ installation, upkeep, and damage.

Key Takeaways

- Let your carrier know if you are adding solar panels.

- It will help you determine your rate increases if you need to add more coverage. If you have coverage under the policy you already have.

- Whether leasing or buying, you may need to increase your coverage.

What Are the Benefits of Getting Solar Panels?

Solar panels can boost the value of your home while providing access to clean energy for your home. Some states may even provide homeowners with tax incentives and credits to help with the upfront costs of acquiring solar panels. Solar panels and home insurance work well together, as many policies include them within your coverage. You can even install solar panels without the threat of backlash from your homeowners association (HOA) due to solar rights laws in states such as Texas, so long as they are within the law’s guidelines.

With so many great benefits and millions of homes already enjoying solar panels throughout the United States, it’s important for those considering installing them to understand how solar panels work with your home insurance. Let’s review.

Does Home Insurance Cover Solar Panels?

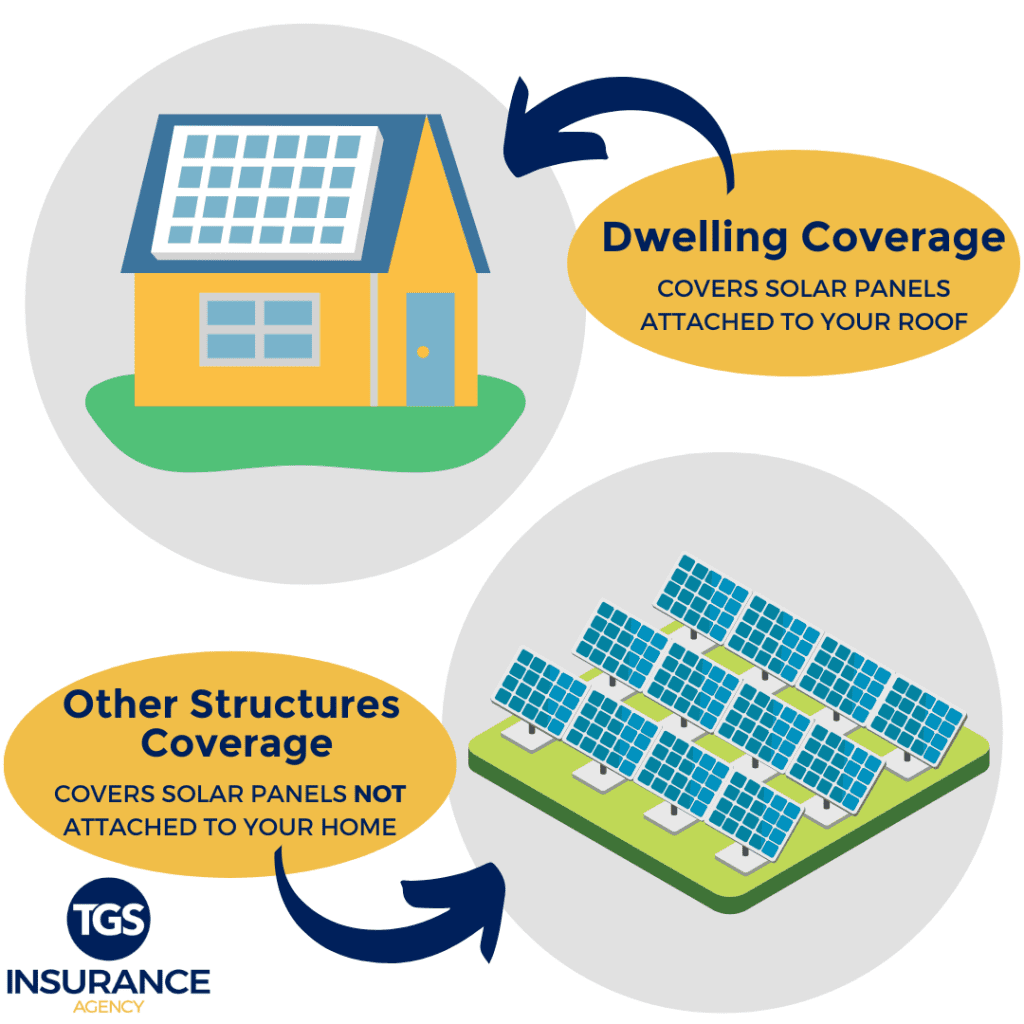

If you have solar panels attached to your house- like your roof- it is likely covered by your homeowners insurance. The portion of your home insurance that would cover these permanent fixtures to your home would be your dwelling coverage. Typically, dwelling coverage protects the physical structure of your home and other structures that are attached to your home. This includes decks, patios, and even roof-mounted solar panels.

TGSI Tip: Some carriers do not cover damage to roof-mounted solar panels from wind or hail.

If you were to opt-in for solar panels that are not attached to your home- like ground-mounted panels- the coverage could come from your other structures coverage. This could also be your case if you put solar panels on your shed. Other structures coverage is for features on your property that are not directly attached to your dwelling- like certain detached garages, sheds, and ground-mounted solar panels.

Do I Need Insurance for Leased Solar Panels?

Leasing solar panels will cost anywhere from $50 to $250 a month. This method will allow you to integrate solars into your daily life without paying the investment upfront. You can better know if solars fit you and your lifestyle without dropping over $20,000. When it comes to leasing solar panels and insurance, it varies case-by-case. Some solar panel companies have their own insurance, so you are not required to purchase additional coverage. There are also cases where leasing companies require you to get insurance for your leased solar panels.

If you add solar panels to your home- buying or leasing- you should tell your insurance provider. Please note that if you lease panels and choose to insure them yourself, your insurance provider may place a limit on claim payout for wind and hail damage.

Do Solar Panels Increase Home Insurance?

Typically, you will not see an immediate increase in your home insurance premium after installing solar panels. You will need to increase your coverage, though. This will take into account your replacement cost

While solar panels may not increase your home insurance rates, we recommend that you review your policy when installing a system. Solar panels can cost over $10,000 and boost the value of your home. Increasing your premium helps protect your new investment without a dire cost change.

Home Insurance Coverage Made Easy

Finding an insurance provider that can find coverage options that meet your budget and understand the needs of a home with solar panels can be tricky. At TGS Insurance, we work with various top-rated insurance carriers, many of which are fully equipped to navigate solar panels and home insurance policies. As an agency, instead of working with a single brand to provide coverage, we shop multiple brands for the most coverage at the lowest rate to ensure savings without lacking the coverage you require. Home insurance policies can be bundled with auto insurance, windstorm, or flood policies for more coverage options and higher savings. Contact us today and let our team of experts find the right home insurance policy for you!

Instant Home Insurance Quote

Recent Home Insurance Articles:

- Does Home Insurance Cover Vacation Rentals? Here’s What You Need to Know

- Home Insurance Coverage Gaps You Might Not Know Exist—Until It’s Too Late

- Grilling Safety Tips for a Secure Memorial Day BBQ

- How to Change Home Insurance with Escrow: A Step-by-Step Guide

- Pool Safety Tips for Homeowners: Stay Cool and Covered This Summer