What is New Car Replacement Coverage?

New car replacement insurance is an add-on coverage that will replace your totaled vehicle with a brand new car that’s the same make and model. While the specifics may vary by carrier, to qualify for new car replacement coverage, you will often need to carry comprehensive and collision coverages. Additionally, your vehicle must be relatively new (actual age and mileage maximums will usually apply, depending on your carrier). Many carriers also have limits on how long you can carry the coverage.

Not every insurance provider offers new car replacement options. Those that do, have their own rules. For example, Allstate will offer new car replacement coverage if your vehicle is two model years or newer, while Travelers requires you to be the vehicle’s original owner and states the vehicle must be the current or future model year at the time you add the coverage. Travelers also specify that you can only hold the coverage for the first five years of ownership.

If new car replacement coverage is something that you are interested in adding, be sure to talk to your agent so that they can find you the best fit!

What Are The Benefits of New Car Replacement Coverage?

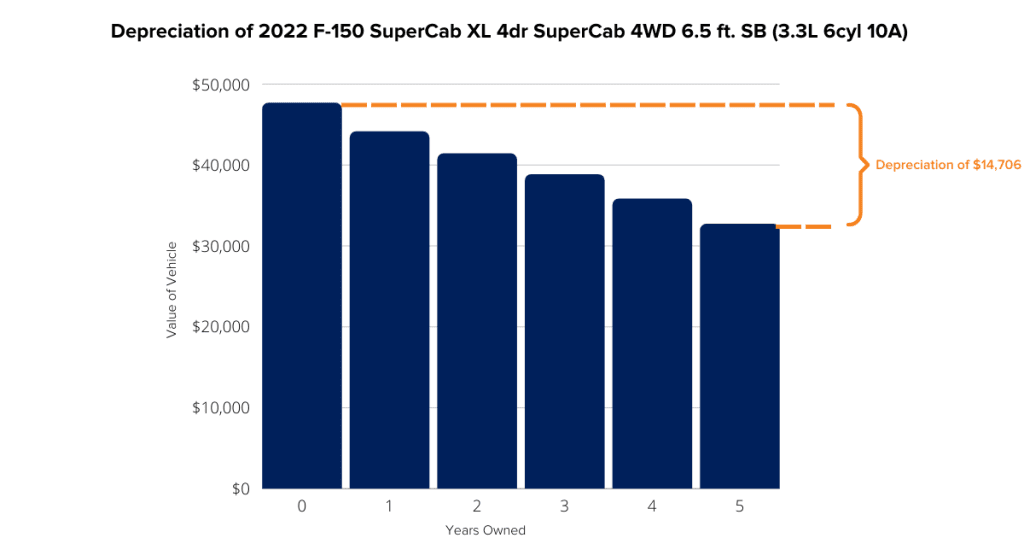

Without new car replacement coverage, your standard full-coverage policy would pay out the actual cash value of your car. The actual cash value is the car’s value minus depreciation for age, condition, and obsolescence. Let’s say you purchase a Ford F-150 for $47,667 from your local Ford dealer. According to Edmunds.com, the Ford F-150 would be worth only 69% of its value within five years.

source: edmunds.com

If the vehicle were totaled in the example above, a customer without new car replacement coverage would receive $32,961 (less your deductible) from their insurance company. A customer with new car replacement would receive a check closer to the original $47,667 that would fully cover the cost of a new car (less your deductible). So a big question to ask yourself when considering this coverage is: if I were in an accident and totaled my car, would I be able to afford to pay the difference out of pocket to purchase a new one?

New Car Replacement vs. Gap Insurance

While both coverages help to cover the difference between the actual cash value of your vehicle and its original value so that you are not left owing a lot of money, the purpose of each is different.

Gap insurance will pay the difference between the actual cash value and what you owe on your car loan or lease. You need to subtract what you have already paid off and what you paid as a down payment.

Let’s circle back to the example of the $47,667 2022 F-150 from earlier. Let’s say you total the vehicle in year 3 of ownership, so your actual cash value, including depreciation, is about $38,830. New car replacement coverage would pay the full difference (less your deductible) to buy a new 2022 F-150, while gap insurance will pay the difference between your claims payout and what you owe on your car loan or lease contract.

Consult with Your Local TGS Insurance Agent to Find Out If New Car Replacement Coverage Is Right For You

Whether new car replacement coverage is something that you think you might be interested in or you’re still on the fence about it, our agents are here to help you. There are many factors to consider when deciding if the add-on coverage is right for you, and we are here to guide you through them. If you are already a customer, reach out to your agent or contact us through the website via the sidebar form. If you are shopping your policy, or just considering your options, start with a free, no-hassle instant auto quote.

Learn More About Auto Insurance Coverages:

Personal Injury Protection Coverage (PIP)

Uninsured and Underinsured Motorist Coverage