What Is a Homeowners Insurance Quote?

A homeowners insurance quote is the proposed amount that you would pay an insurance carrier to cover your home. The quote will be based on many factors, including your home’s age, building features, location and size, as well as your insurance score. This proposed estimate can change in price as your agent works to refine your quote so that it’s curated to suit your unique coverage needs. To feel confident in your policy before you sign, make sure you understand how to read a homeowners insurance quote.

How Do You Get a Quote on Home Insurance, and How Long Does it Take?

You can get a free homeowners insurance quote by visiting the carrier website or by consulting an independent agency like TGS Insurance. Providing your information to get an insurance quote will not hurt your credit score. It can take up to a few days to get your quote, depending on the carrier or agency. At TGS Insurance, your free home insurance quote is instant! Quotes that are ready quickly are usually based on a small subset of information, then the initial baseline quote is refined during the underwriting process. Quotes that take several days are based on more extensive information and are usually the finalized quote.

>> TGSI TIP: Homeowners insurance quotes should always be free. You only pay when purchasing the policy.

What Makes Your Homeowners Insurance Quote High?

A lot of factors go into calculating your home insurance premium. The most common causes of a high premium include:

- Attractive nuisances (for example, trampolines)

- High value of personal property

- Low insurance credit score (impacted by claim history)

- Low deductibles

- Building materials and/ or size of the house

- Age of the roof and/ or house

>> TGSI TIP: Use an independent insurance agency like TGS Insurance to compare quotes for you and find the lowest cost for the coverage you need.

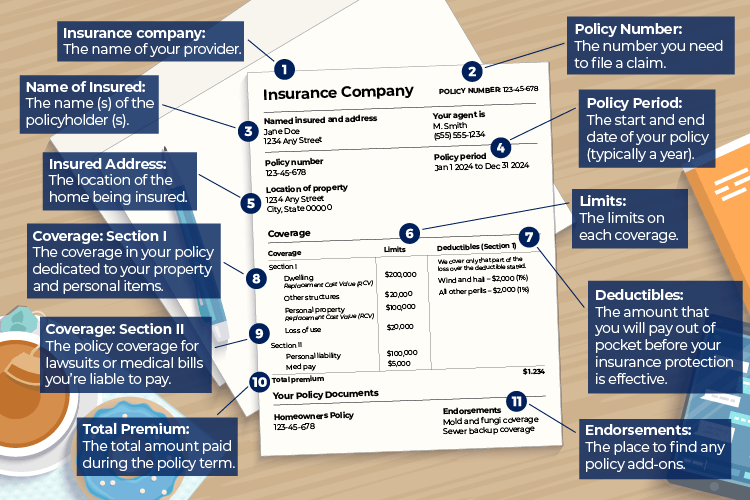

How to Read Your Homeowners Insurance Quote

- 1. Insurance Company

- 2. Policy Number

- 3. Name of Insured

- 4. Policy Period

- 5. Insured Address

- 6. Limits

- 7. Deductibles

- 8. Coverage: Section I

- 9. Coverage: Section II

- 10. Total Premium

- 11. Endorsements

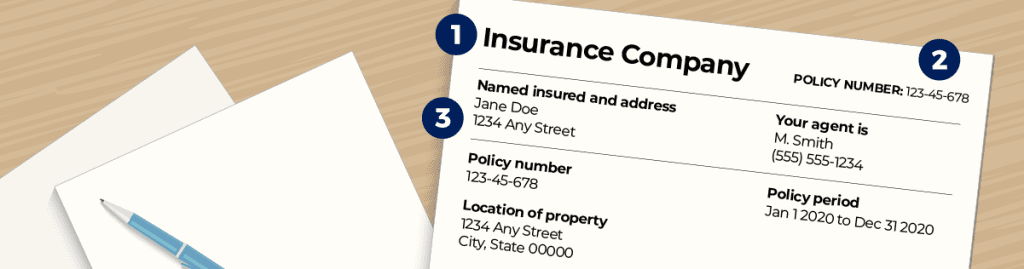

1. Insurance Company

The name of the carrier that will be insuring your home can be found at the top of your quote. Sometimes this will actually be a subsidiary company of a parent insurance carrier. For example, you may receive your insurance through ASI Progressive, which is part of the Progressive Group of Insurance Companies.

2. Policy Number

If you ever need to file a claim, this policy number is what you will use. This number is sometimes helpful when consulting with your insurance agent, as well. Keep your policy number somewhere secure.

3. Name of Insured

The quote preparation section of your homeowners insurance will list the names on the policy, the billing address, and other general contact information.

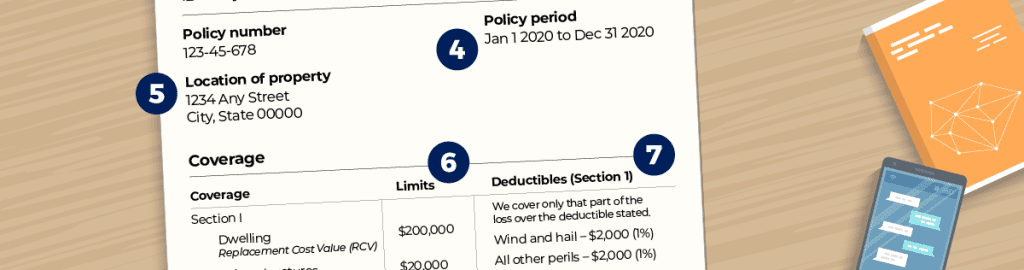

4. Policy Period

The policy period will indicate the start and end dates of your insurance coverage with this specific policy. You will need to renew before the end date to avoid a lapse in your home insurance coverage.

>> RELATED READING: What Is the Difference Between HO2 and HO3 Homeowners Policies?

5. Insured Address

Your home’s location is a critical piece of the calculations that determine your homeowners insurance premium. If you only own one home, double check that your address is correct! If you own multiple properties, confirm that your billing address and insured location are both accurate.

6. Limits

This portion of your home insurance quote breaks down the maximum amount that your home insurance policy will pay for each type of coverage. If you suffer from losses or damages beyond those limits, you will be responsible for paying the rest out of pocket.

7. Deductibles

In the event of a worst-case scenario, your deductible is the amount you’ll be obligated to pay out-of-pocket before your insurance will step in to foot the rest of the bill. You can expect to see an All Perils deductible and/ or a Windstorm/ Hail deductible here, depending on your policy. You can always ask your insurance agent to clarify what perils, or causes of financial loss, are covered by your policy and fall under the All Perils deductible. If Windstorm/ Hail is not included, you may need a separate windstorm insurance policy for that coverage.

>> TGSI TIP: If you can afford to raise your deductible, doing so will lower your premium!

8. Coverage: Section I

This section of your home insurance quote details the coverages relating to your property:

- Coverage A (Dwelling): This covers the structure of your house.

- Coverage B (Other Structures): This covers any structures on your property not directly attached to your house, like your fence or detached garage.

- Coverage C (Personal Property): All of your personal belongings, including your clothing, furniture, and appliances, fall under this coverage when they are on your property. Ask your insurance agent to learn how much coverage your belongings will get when they’re off the premises.

- Coverage D (Loss of Use): When your house is uninhabitable following a covered peril, your insurance carrier will provide room and board for a limited time under this coverage. Clarify the conditions of this coverage with your insurance agent, as they vary from carrier to carrier.

>> TGSI TIP: An insurance quote is a summary of the proposed policy. Your agent will provide your complete policy overview.

9. Coverage: Section II

When someone is injured or suffers damage to their belongings while on your property, you are responsible for paying for their financial losses. This section of your home insurance quote details the coverages relating to your liability:

- Coverage E (Personal Liability): This covers a claim or lawsuit against you for bodily injury or personal property damage that occurred at your homesite.

- Coverage F (Medical Payments): The amount your insurance carrier will pay for medical treatment of injuries that happened at your homesite falls under this coverage. This number is typically per person, per accident.

10. Total Premium

This is the sum that you will pay for this homeowners insurance policy. If you choose to pay in monthly or quarterly installments, the payment breakdown and any other itemized fees that are calculated into your premium will be listed here, as well.

>> TGSI TIP: Some carriers offer a discount for paying in full, upfront.

11. Endorsements

Here you will find any policy add-ons. These are optional coverages meant to help round-out the baseline coverage of a standard policy. Consult your agent if you’re unsure of which homeowners endorsements make sense for your unique insurance and budgetary needs.

>> RELATED READING: Homeowners Endorsements

How to Save Money on Your Homeowners Insurance

Ask Your Agent if You Qualify for Discounts

There are plenty of discounts available to help reduce the cost of your home insurance! Some important discounts come from you taking measures that make your home more secure, such as upping your home security or making your coastal home more weather-resistant to earn a windstorm certificate. These discounts can amount to some huge savings! However, the only way to be confident that you are getting the lowest possible price for the insurance coverage you need is to shop for the best deal.

Find the Insurance Carrier and Policy That Make Sense for You

Carriers weigh the factors that determine your premium differently, so comparing quotes can make a huge impact! Even so, many homeowners don’t bother because comparing dozens of quotes can be a time-consuming headache. The best way to maximize your savings while saving yourself the hassle is to use an independent insurance agency, like TGS Insurance.

Our mission at TGS Insurance is to find you the best possible deal without sacrificing the coverage you need. That’s why we will shop for your home insurance with our roster of over 55 A-rated carriers! Trust our experts to get you a policy that makes sense for you. It starts with a free, instant quote.

Instant Home Insurance Quote

Recent Home Insurance Articles:

- Thanksgiving Fire Safety: Protect Your Home, Your Family, and Your Peace of Mind

- Fall Home Maintenance Checklist: Prevent Costly Insurance Claims Before Winter

- Who Needs to be Listed on Homeowners Insurance

- Does Homeowners Insurance Cover Mold?

- Actual Cash Value vs. Replacement Value: What’s the Difference, and Where Does Market Value Fit In?